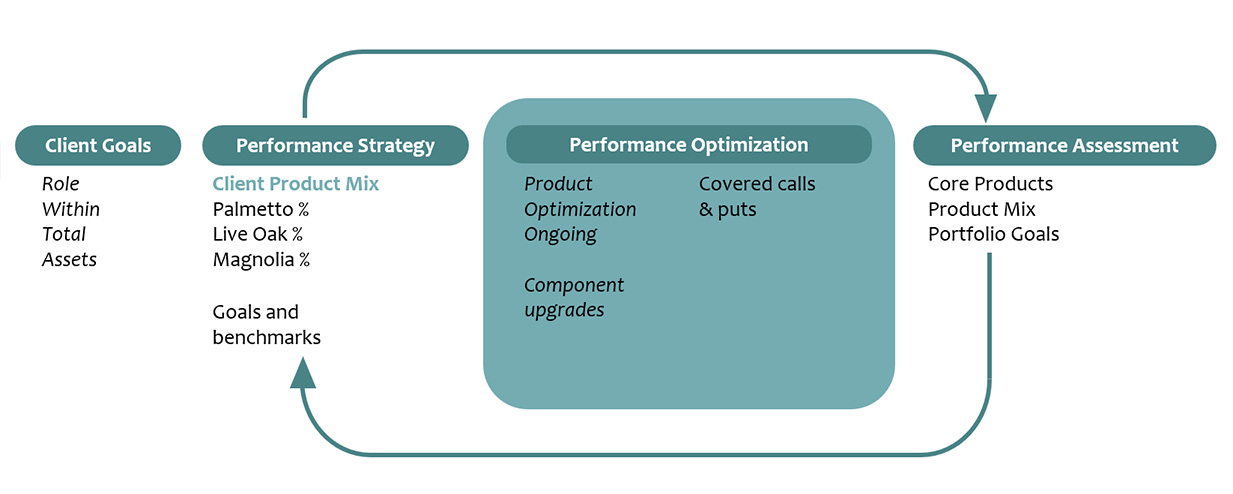

Our customized strategy for each client begins with a detailed understanding of goals.

What sets us apart is the use of our proprietary product strategies: Palmetto, Live Oak and Magnolia.

Each strategy is customized to address investment objectives and risk tolerance of individual client families. No two portfolios are exactly the same, but each shares a common investment chassis and long-term goals.

As part of our process, we hold regularly scheduled performance reviews. We measure results against client objectives and market benchmarks.*

Start now with our services and grow your wealth

Disciplined Process

Tidal Creek Capital Performance Optimization

Proprietary Product Strategies

Growth & Income

- Targeted to Outperform S&P Benchmark over the long term.

- Managed with hedge fund characteristics for downside protection.

- Makes use of short positions and options as appropriate.

- Nimble.

Income

- High-yield replacement for money market, CD, or checking.

- Portfolio consists of:

- Bonds

- Select equities with superior balance sheets

- REITs

- Diversified, high-yield bonds

- Current effective yield: 4.2% (September 2019)

- Many clients choose to link to a checking account or debit card for on-demand withdrawals

Small Company Focus

- Generally suitable for smaller account sizes.

- Makes use of a series of broad asset class ETFs.

- Highly-customizable according to client risk profile and goals.

The Value of Covered Calls and Puts

Covered calls:

- Used on existing holdings.

- Enhance return via a “forced dividend”.

- Lower volatility.

The strategy of writing covered calls, when compared to simply buying and holding equity positions, increases returns and lowers portfolio volatility.

Financial Planning Process

-

Step 1

Initial Meeting

Discuss current financial framework. Onboard with planning software.

-

Step 2

Planning Meeting

Present Tidal Creek Capital recommendations.

-

Step 3

Ongoing Support

Track progress. Revisit consistently and adjust as needed.