Pessimism Reigns

To date, 2022 has been ugly. On the global stage, there’s a war in Ukraine threatening to expand. Global interest rates are on the rise, supply chains are still dysfunctional while the global economy has not fully recovered from Covid. Meanwhile back home in the U.S, inflation is at levels last seen forty years ago, the likelihood of an impending recession looms as a dark shadow, and confidence in the American President is near an historic low (1). All around, pessimism reigns. The US stock market reflects the mood. The S&P 500 is down approximately 23% for the year, and all gains from 2021 have been wiped out. From its peak made on January 4th of this year, the market has now lost a quarter of its value.

Fortunately for our clients, your accounts have not suffered the full brunt of the Market’s decline. Despite your declining statement balances, on a relative basis we’re having a good year. We are generally running several percentage points ahead of the Market’s return in our clients’ accounts. It may sound like a hollow victory, but it’s important. Protection in a down market is a strength of our firm. Our conservative positioning has insulated you against the losses to a significant degree. Our goal is to capture the majority of the market’s upside while limiting the damage of the down years. That is indeed what we are seeing.

Buy Low, Sell High

Buy low, sell high. Simple… right? What is left unsaid in that simple old market axiom is that Low almost always feels dreadful. Low comes with fear, pessimism, and dire forecasts for the future. Low feels a lot like… well, like this. Warren Buffet once said, “Remember that the stock market is a manic depressive.” He’s right. The current market is not only depressed numerically, it’s in a period of psychological gloominess. The mood on Wall Street is sour and threatening to spill over to Main Street.

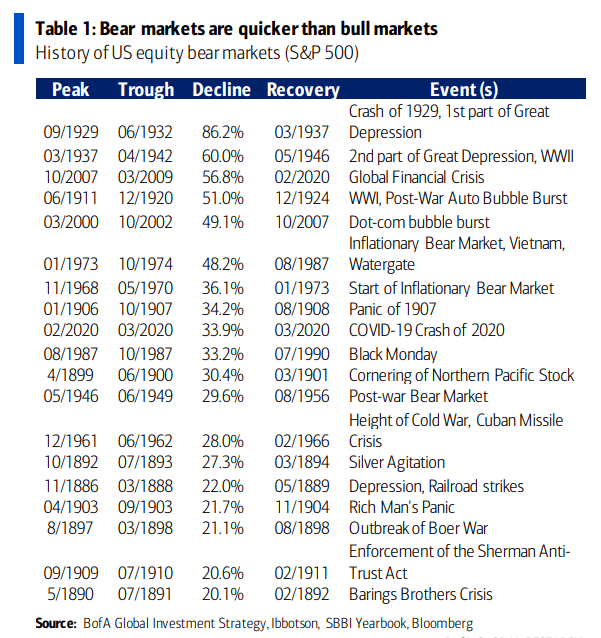

So, have we reached Low? Is this the bottom? Probably not yet. The evidence indicates that we still have some downside before we stabilize. Take a look at the attached graphic published by Bank of America’s Global Investment Strategy. It ranks Bear Markets from the worst (at the top) to the least damaging. As you can see, the rough midpoint of all bear markets over the past 100+ years is in the down 30 – 34% range. Down 25% as I write this update, we are now closing in on the less extreme end of that range. If we are in a garden variety Bear Market, we can expect that we are significantly more than halfway to the Market’s eventual low. We’ll only know the exact eventual low well after the fact, but history is a good guide to set expectations. The specific reasons for pessimism and market declines vary, but human psychology remains constant. Humans are prisoner to our waffling cycles of fear and greed. The result is that we sell into pessimism and buy into optimism. Nothing changes on human emotion. That’s what makes Buy Low, Sell High so much harder in practice.

It’s Too Late to Sell and Too Early to Buy

We are still buying and selling as needed to adjust our positions, but in general at this point selling mass quantities of quality positions does not make sense. Only those who are forced to cash-out for liquidity reasons should sell quality securities into these depressed prices. Recessions and bear markets are normal aspects of investing. The worst thing an investor can do is sell at or near the point of peak pessimism. Retail investors habitually make this mistake. They fall into the fallacy that the current environment will persist indefinitely. Thus, although they understand the Buy Low / Sell High philosophy at a base level, they fail to comprehend the trap set by the optimism / pessimism that accompanies each extreme of High and Low. As a result, retail investors often perform in action the exact opposite of what they set out to do. To avoid this destructive psychology, a disciplined trading plan is critical.

Nervous Nellies

Lastly, over the past decade I have developed my own internal indicator unique to our firm. It’s anecdotal, but reliable. Most of our clients have been through this environment before, including during the Covid Crash of 2020. You are now seasoned. You understand the ups and downs of the business cycle and take a thoughtful approach to the long term when dealing with the stress of a Bear Market. However, a few of you are “Nervous Nellies”. You know who you are. And I don’t say this to deride you. You are smart, accomplished people and have worked hard to accumulate the assets that are entrusted to us. I understand the disheartening feeling caused by thinking that a substantial portion of your hard-earned wealth could rapidly evaporate if you do not take action upon yourself. But this is rarely (almost never) the right move. Further, when I begin getting more frequent calls from our own Nervous Nellies, it gives me a window into the soul of the market and gain direct insight into the prevailing psychology. Almost without fail, when our Nellies’ voices reach their most vocal, we’re approaching a point of maximum pessimism. I’ve heard from quite a few of you recently. I can’t say we’re there yet, but we’re approaching Low.

Strap in. It may be a difficult late Summer and Fall as we continue to weather this unstable global environment. Meanwhile, we remain clear-headed as to our mission. What we own for you is quality. We planned for the likelihood of a recession and are not surprised by 2022. Increasingly, fad investments and dubious quality securities (NFTs, crypto currencies, meme stocks, etc.) are being punished. I expect we’ll see further divergence between quality and speculative investments through this period which should continue to work to our relative benefit. As a parting thought, we have not spoken about potential positive catalysts in this message, but we do see two: 1) Corporate earnings and the health of the American consumer have remained generally healthy to this point, and 2) Mid-term elections this Fall could provide a positive charge to the political narrative. We are exploring each in depth.

Note (1): See How Popular Is Joe Biden? | FiveThirtyEight

Jonathan Boyd

Direct: (843) 540-1149